Look, let’s face it, saving the world is a messy business. You could be dodging laser beams one minute and battling a giant robot the next. All that heroism is bound to leave a trail of collateral damage – not to mention a few singed eyebrows on your part.

So, the question begs asking: what happens when your super suit gets snagged on a falling satellite dish or your heat vision accidentally melts a priceless museum statue (whoops!)?

Here at Bill Palmer Insurance, we understand the unique needs of the super-powered community. That’s why we offer “Super Shield,” a comprehensive insurance plan designed to have your back (or, depending on your powers, your super-strong abs) when things get a little… cataclysmic.

“It’s tough to do a good deed. Just look at your professional good deed doers. Your Lone Rangers, your Superman, your Batman, your Spider-Man, your Elasticman. They are all wearing disguises, masks over their faces. Secret identities. Don’t want people to know who they are. It’s too much aggravation. ‘Superman, yeah thanks for saving my life, but did you have to come through my wall? I’m renting here, I’ve got a security deposit. What am I supposed to do?'” — Jerry Seinfeld

Now, let’s get down to the nitty-gritty. Here’s what you need to consider when it comes to superhero insurance:

-

The “Oops, I Leveled a Skyscraper” Clause: Let’s face it, even the most graceful hero can have a “whoops” moment. Our “Oops Clause” covers any accidental property damage incurred during villain takedowns. Just remember, we can’t cover everything. Using a city bus to swat away a rogue space squid probably falls under “intentional destruction” (sorry, Captain Comet).

The “Oops, I Leveled a Skyscraper” Clause: Let’s face it, even the most graceful hero can have a “whoops” moment. Our “Oops Clause” covers any accidental property damage incurred during villain takedowns. Just remember, we can’t cover everything. Using a city bus to swat away a rogue space squid probably falls under “intentional destruction” (sorry, Captain Comet). -

The “Crippling Medical Bills (For When You’re Not Invulnerable)” Clause: Not all heroes are bulletproof. Our plan offers top-notch coverage for those inevitable kryptonite hangovers, adamantium shard removals, or the occasional bout of laser-eye fatigue. Pre-existing conditions like super strength or heat vision are welcome, but the premium might be a little… fiery.

-

The “Secret Identity’s Out? We Got You” Clause: Being a hero is all about sacrifice, but revealing your secret identity shouldn’t cost you your livelihood. We offer legal protection in case your civilian life gets caught in the superhero crossfire (looking at you, Masked Mailman).

-

The “Fashion Faux Pas” Clause: Let’s be honest, some superhero costumes are… questionable. Our “Fashion Faux Pas” clause covers any property damage caused by capes getting caught in jet turbines or utility belts accidentally setting off sprinklers in museums.

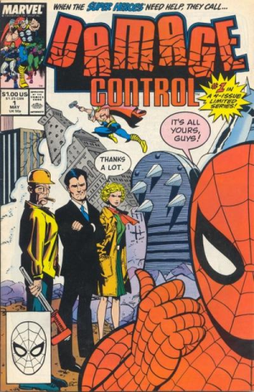

In Marvel there is a “team” called Damage Control that cleans up after superhero battles. They had a limited run series back in the 80’s. Damage Control is a fictional construction company appearing in American comic books published by Marvel Comics. The company specializes in repairing the property damage caused by conflicts between superheroes and supervillains.

In Marvel there is a “team” called Damage Control that cleans up after superhero battles. They had a limited run series back in the 80’s. Damage Control is a fictional construction company appearing in American comic books published by Marvel Comics. The company specializes in repairing the property damage caused by conflicts between superheroes and supervillains.

Now, the big question: how much does all this cost? Well, buckle up, because superhero insurance ain’t cheap. We have to factor in things like:

-

Your “Heroic Hazard Rating“: Do you fight space pirates or purse snatchers? The more cosmic your threats, the higher the risk, and the higher the premium. Sorry, neighborhood watch heroes, your squirrel-battling exploits might not qualify for the top tier.

-

Your “Destructive Tendencies“: Let’s face it, some heroes are just more accident-prone than others. If your battles leave a trail of smoldering buildings and cratered streets, expect a hefty premium (looking at you again, Captain Comet).

-

Your “Super Suit Durability“: A vibranium suit can take a beating, but a spandex onesie? Not so much. The more durable your costume, the lower the replacement cost (unless your superpower involves spontaneously combusting, then all bets are off).

But wait, there’s more!

We believe in rewarding responsible heroes. So, here are some ways to lower your premium:

-

Take Our “Heroic Hazard Awareness” Course: Learn how to fight bad guys without turning the city into a demolition derby. You might even pick up some valuable tips on cape maintenance!

-

Join Our “Superhero Safety Patrol“: Volunteer your time helping the community, and we’ll reward you with a discount. Remember, prevention is key (and way cheaper than replacing a city bus).

-

Bundle Your Policies: Combine your superhero insurance with your home and car insurance (assuming you still own a car after that whole space squid incident). We love a good bundler!

There was a ‘Superman’ from the ’50s where a slick talking insurance man talked Supes into buying an insurance policy. The entire world would be the beneficiary if the Man of Steel died.

So, there you have it! Superhero insurance – it’s not a phone booth, but it can save your, well, everything else. Remember, we’re here for all your super-powered needs. Just don’t ask us to cover world-ending events – that’s what the Avengers are for. If you know a super-hero who could use full coverage, or just want to insure your bat-mobile or your very own Fortress of Solitude, contact Bill Palmer today.

Featured image by Yogi Purnama